It is possible to get UK car insurance with a foreign driving licence, but it is often more expensive.

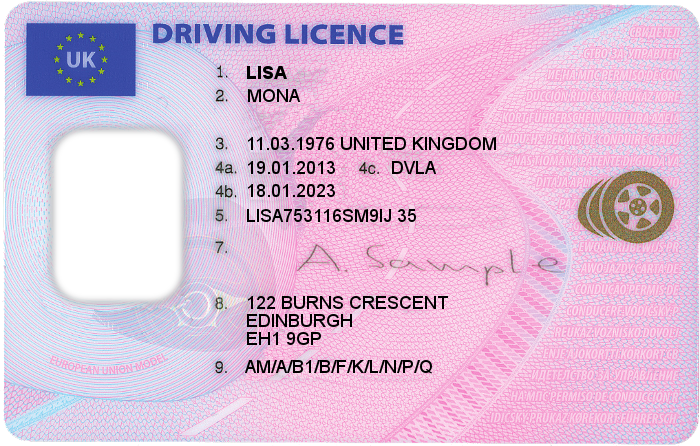

It means you could actually save money by taking out fully comprehensive car insurance while being better protected.Ĭan I get car insurance with an international driving licence? You may expect third party only cover to be more affordable, as your insurer would only have to pay out for the other party’s repair costs if there's a claim.īut over the years, insurers raised prices after realising that third party only cover was being used as a cost-saving tactic by risky drivers. Third party, fire and theft (TPFT): this gives you TPO cover but also protects your car against fire damage or theftĬomprehensive cover: this includes everything you get with TPFT as well as covering you and your car if you're involved in an accident. Third party only (TPO) cover: this is the minimum legal requirement and only covers damage to other vehicles and property. There are three levels of car insurance available in the UK: Yes, you’ll need car insurance for driving on an international licence in the UK even if you only intend to drive occasionally or for a short period. If you want to keep driving on an international licence in the UK for more than 12 months, you’ll need to get a provisional driving licence and pass the UK driving test. It can be a bit tricky if your licence was issued in a non-EU/EEC or non-designated country, including the US.

You can drive in the UK for up to 12 months on a licence issued in Gibraltar, Jersey, Guernsey, Isle of Man or a ‘designated country.’ If you have an exchangeable international licence.If you become a UK resident, the good news is you can simply swap your EU/EEC licence for a UK one – you won’t need to take the UK driving test. You can keep driving in the UK until you’re 70 years old.

0 kommentar(er)

0 kommentar(er)